When you pick up a generic prescription at the pharmacy, you might think the price is simple: lower cost, same medicine. But behind that $4 copay is a complex web of federal and state laws, reimbursement formulas, and financial incentives that determine exactly how much the pharmacy gets paid-and whether they can even afford to fill your script. These rules don’t just affect pharmacists. They shape what drugs you can get, how much you pay out of pocket, and even whether your local pharmacy stays open.

How Generic Drugs Are Paid For: The Two Main Models

Pharmacies don’t get paid the same way for every drug. For generics, reimbursement mostly follows one of two systems: Average Wholesale Price (AWP) or Maximum Allowable Cost (MAC). AWP used to be the standard, but it’s largely outdated now because it’s based on list prices that often have nothing to do with what pharmacies actually pay. Today, MAC is the dominant model for generics.MAC sets a fixed maximum payment per pill or capsule based on the lowest price pharmacies are actually paying to buy the drug. If the pharmacy buys a 30-day supply of lisinopril for $3.50, the MAC might be set at $4.25. The pharmacy gets reimbursed $4.25, keeps the $0.75 difference, and pockets a small profit. But if the pharmacy paid $5 for that same pill-maybe because they bought from a more expensive wholesaler-they lose 75 cents. That’s why many independent pharmacies now only stock generics they can buy at or below MAC.

This system was designed to save money for insurers and taxpayers. But it also creates a squeeze. In 2023, the average profit margin on generic drugs was just 1.4%, down from 3.2% in 2018. For small pharmacies, that’s not enough to cover rent, staff, and pharmacy software. Some have stopped carrying certain generics altogether because the reimbursement doesn’t cover their cost.

Substitution Laws: When the Pharmacist Can’t Choose

Every state has laws that allow pharmacists to substitute a generic drug for a brand-name version-unless the doctor says “dispense as written.” These are called substitution laws. They’re meant to save money, and they work: 90% of prescriptions filled in the U.S. are for generics.But here’s the catch: substitution laws don’t always match up with reimbursement rules. A pharmacist might be legally allowed to switch your brand-name drug for a generic, but if the insurance plan doesn’t reimburse the pharmacy enough for that generic, they might not even have it in stock. Or worse-they might have it, but only if you pay more out of pocket.

Some states require pharmacies to inform patients if a generic substitution will cost them more than the brand. But in most places, that’s not required. Until 2018, many pharmacy contracts included “gag clauses” that prevented pharmacists from telling you that paying cash might be cheaper than using your insurance. That’s right-your pharmacist couldn’t tell you that the $12 generic you were being charged through insurance was actually $8 if you paid out of pocket. Those clauses are now banned, but the problem hasn’t gone away. Many patients still don’t know they have options.

Medicare Part D and the Hidden Costs of Formularies

Medicare Part D covers prescription drugs for over 50 million seniors and disabled Americans. It’s not one plan-it’s hundreds of private plans, each with its own list of covered drugs called a formulary. These formularies are divided into tiers. Generics usually sit on Tier 1, with the lowest copay. But that doesn’t mean they’re always cheap.Some plans put certain generics on higher tiers if they’re not on the plan’s preferred list. A patient might be prescribed a generic version of metformin, but if their plan doesn’t favor that particular manufacturer, they could pay $20 instead of $5. And if the plan requires prior authorization, the patient might wait days to get their medication-even though the drug is generic and widely available.

As of 2022, 28% of Medicare Part D plans required prior authorization for at least one generic drug. That’s not just bureaucracy-it’s a barrier to care. Seniors on fixed incomes skip doses or go without because they can’t afford the delay or the cost.

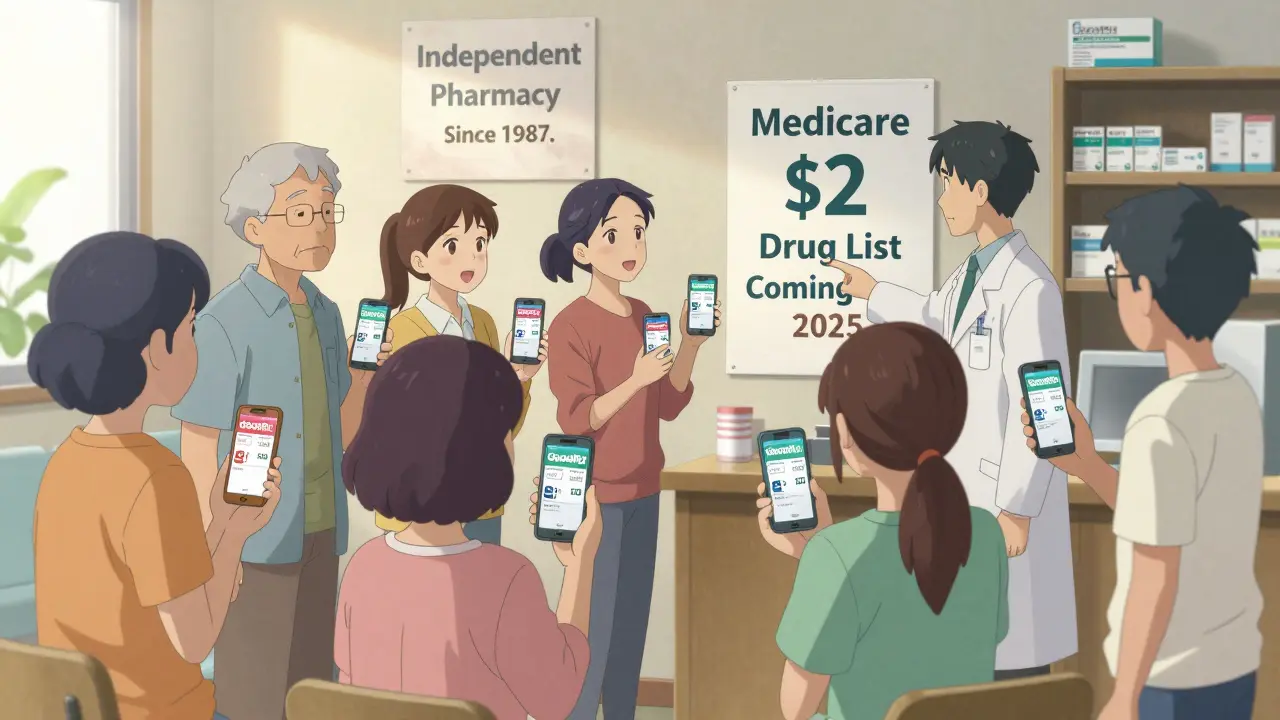

There’s a new model in the works: the Medicare $2 Drug List. Proposed by CMS in 2025, it would let Part D plans offer a list of about 100-150 low-cost, high-use generics-all with a $2 copay. The drugs would be chosen based on clinical guidelines, how often they’re used, and how many manufacturers make them. If it works, it could simplify things for millions. But it’s still voluntary, and no plan is required to join.

How PBMs Control the Game

Behind most insurance plans are pharmacy benefit managers-PBMs. CVS Caremark, Express Scripts, and OptumRX control over 80% of prescription claims in the U.S. They negotiate drug prices with manufacturers, set reimbursement rates for pharmacies, and design formularies. But their business model isn’t transparent.PBMs make money in three ways: rebates from drugmakers, the “spread” between what insurers pay and what pharmacies get paid, and fees from pharmacies to be on their network. The spread is the biggest issue. If an insurer pays $10 for a generic drug, and the PBM pays the pharmacy $7, the PBM keeps $3. That’s profit. But the pharmacy doesn’t know what the insurer paid. The patient doesn’t know. And the pharmacy often loses money because the $7 they get doesn’t cover what they paid to buy the drug.

Drug manufacturers say PBMs force them to raise list prices to cover the rebates they give back. That creates a cycle: higher list prices → bigger rebates → higher premiums → more pressure on pharmacies to cut costs. Meanwhile, generic drug prices keep falling, but pharmacy reimbursements don’t always keep up.

Medicaid and the Rebate System

Medicaid covers 85 million Americans, and it’s one of the biggest drivers of generic drug use. The Medicaid Drug Rebate Program requires manufacturers to pay rebates to states for every drug dispensed. Those rebates help lower costs for taxpayers.Each state creates a Preferred Drug List (PDL), which tells prescribers which generics are preferred and which need prior authorization. If a drug isn’t on the list, the pharmacy might not get paid unless the doctor jumps through hoops to justify the prescription. This system saves money-but it also limits access. A patient in one state might get a generic for free. In another, they might need a 10-page form just to get the same drug.

States are starting to regulate PBMs more closely. As of 2023, 44 states passed laws to increase transparency around pharmacy reimbursement, ban spread pricing, or require PBMs to pass rebates to consumers. But enforcement is patchy. And the big PBMs still have the upper hand.

What’s Changing in 2025 and Beyond

The Inflation Reduction Act of 2022 is starting to reshape the landscape. Starting in 2025, Medicare Part D beneficiaries will have a $2,000 annual cap on out-of-pocket drug costs. That’s huge. It means even if your plan has a high deductible, you won’t pay more than that in a year.Also, the FDA’s Generic Drug User Fee Amendments (GDUFA II) have lowered fees for small generic manufacturers, making it easier for new companies to enter the market. More competition usually means lower prices. But there’s a counterforce: authorized generics. These are brand-name drugs sold under a generic label, often by the same company that makes the brand version. They’re not true generics-they’re just cheaper versions of the brand. And they can block other generics from entering the market, reducing competition.

Industry analysts predict generic drug prices will keep falling 5-7% per year through 2027. But if reimbursement doesn’t rise with inflation, pharmacies will keep losing money. Some are turning to cash-based generic programs-like those offered by Walmart and Costco-to stay afloat. Others are merging with larger chains. Independent pharmacies are disappearing.

What Patients and Pharmacists Can Do

If you’re on a fixed income or just trying to save money on meds:- Ask your pharmacist: “Is this generic cheaper if I pay cash?”

- Use tools like GoodRx or SingleCare to compare cash prices before using insurance.

- If your plan denies coverage for a generic, ask for a formulary exception.

- Check if your plan is part of the Medicare $2 Drug List when it rolls out.

- Support legislation that bans spread pricing and requires PBM transparency.

For pharmacists, the key is advocacy. Many are now pushing back against MAC pricing that doesn’t cover cost. Some are refusing to stock certain generics. Others are partnering with local clinics to offer low-cost medication programs. The system is broken-but it’s not unfixable.

At its core, this isn’t just about money. It’s about access. When a pharmacy can’t afford to stock a generic, it’s not just a business problem-it’s a public health issue. And if we don’t fix the reimbursement model, we’ll keep seeing patients skip doses, delay care, or pay more than they should for the same medicine.

Why do some generic drugs cost more than others?

Not all generics are the same. Even though they contain the same active ingredient, different manufacturers produce them. Insurance plans often favor one brand over another based on rebates or contracts with PBMs. If your plan doesn’t cover the generic your doctor prescribed, you might pay more-or be forced to switch to a different one. Always ask your pharmacist if there’s a lower-cost alternative on your plan’s formulary.

Can my pharmacist tell me if paying cash is cheaper than using insurance?

Yes. Since 2018, federal law bans “gag clauses” that prevented pharmacists from disclosing cash prices. If you ask, your pharmacist must tell you whether paying out of pocket would cost less than using your insurance. Many patients are surprised to find that a $40 generic through insurance is only $12 if paid cash.

Why do some pharmacies run out of certain generics?

If the reimbursement rate (like MAC) is lower than what the pharmacy paid to buy the drug, they lose money on every pill they sell. Many independent pharmacies can’t afford to carry generics that pay less than their cost. They may stock only the most profitable ones or wait for prices to drop. This is especially common with older, low-cost generics that have many manufacturers.

How does Medicare Part D decide which generics to cover?

Each Part D plan has a Pharmacy and Therapeutics committee that reviews drugs based on clinical effectiveness, safety, and cost. They create formularies with tiers: Tier 1 is usually preferred generics with the lowest copay. But plans aren’t required to cover all generics. Some exclude certain ones to save money or push patients toward higher-cost alternatives. Always check your plan’s formulary before filling a prescription.

What is the Medicare $2 Drug List, and will it help me?

The Medicare $2 Drug List is a new voluntary model being tested by CMS in 2025. It would let Part D plans offer a list of about 100-150 essential generic drugs-all with a $2 copay. The drugs are chosen based on how often they’re used, their clinical importance, and whether multiple manufacturers make them. If your plan joins, you’ll pay $2 for those drugs regardless of your deductible. It’s designed to improve adherence and lower costs, but not all plans will participate.

What Comes Next?

The future of generic drug reimbursement isn’t written yet. Will MAC pricing be replaced by direct cost-based models? Will PBMs be forced to pass savings to consumers? Will the $2 Drug List become standard? These are open questions.One thing is clear: the current system favors large corporations over patients and small pharmacies. Until reimbursement reflects real costs-not inflated list prices or hidden rebates-patients will keep paying more than they should, and pharmacies will keep closing their doors.

Change is coming-but only if people speak up, ask questions, and demand transparency. Your next prescription shouldn’t be a gamble.

1 Comments

Man, I used to work at a small pharmacy and this is 100% true. We had to stop stocking like 12 different generics because we were losing 50 cents a pill on them. One guy came in for lisinopril and we told him cash was $3. He was pissed we didn’t tell him sooner. Gag clauses are gone but the damage is done.

Write a comment